An introduction to Indeed’s Restricted Stock Units

In 2021, Indeed began offering Restricted Stock Units (RSUs) as a way to reward employees who contribute to the long-term success of Indeed.

What is an RSU?

RSUs are equity-based incentives issued by an employer in the form of company shares. At Indeed, our RSUs are shares in our parent company, Recruit Holdings, which is traded on the Tokyo Stock Exchange in Japan (6098.T).

Our RSU long-term incentive program has three goals in mind

- To encourage employees to think like owners

- To align incentives with company performance

- To reward employees for the company’s financial success

Why Recruit stock rather than Indeed stock?

Indeed is a wholly-owned subsidiary of Recruit Holdings, which means Indeed does not have publicly traded shares. Indeed is a key part of Recruit’s HR Technology Strategic Business Unit (SBU) and the HR Tech SBU is a significant growth driver for all of Recruit Holdings, and as a result, is a significant contributor to Recruit’s share price performance.

RSU grants

When RSUs are granted to employees, they will be prompted to accept the award via a grant award agreement. The agreement identifies the number of units granted, the vesting schedule, and the specific terms and conditions of the award.

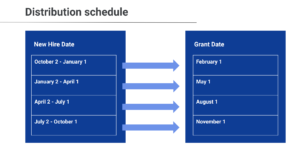

The initial grant date will always be the first day of the second month of an employee’s first full quarter at Indeed. That also means in the case of a start date changing to a new quarter, the grant date will be modified.

For example, if someone starts on Feb 10, 2021, their RSU award will be granted May 1, 2021.

3 steps to calculating RSU value

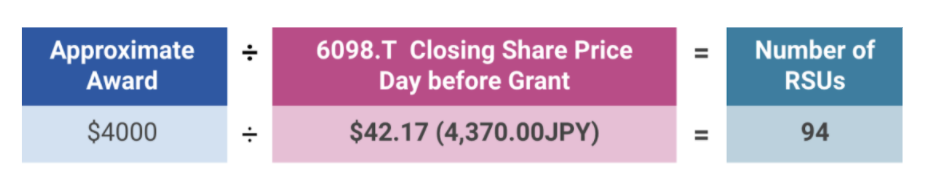

The number of units someone receives will be based on the closing price of Recruit Stock the business day before their grant date.

- A candidate is hired in Q1 of 2021, with an approximate RSU grant value of $4,000 with a grant date of May 1, 2021 (subject to board approval)

- On April 30th the closing price is $42.17 (converted from Japanese Yen)

- The RSU grant would be 94 RSUs (Simply divide the amount by the converted price, rounded down to the nearest whole number.)

When do RSUs vest?

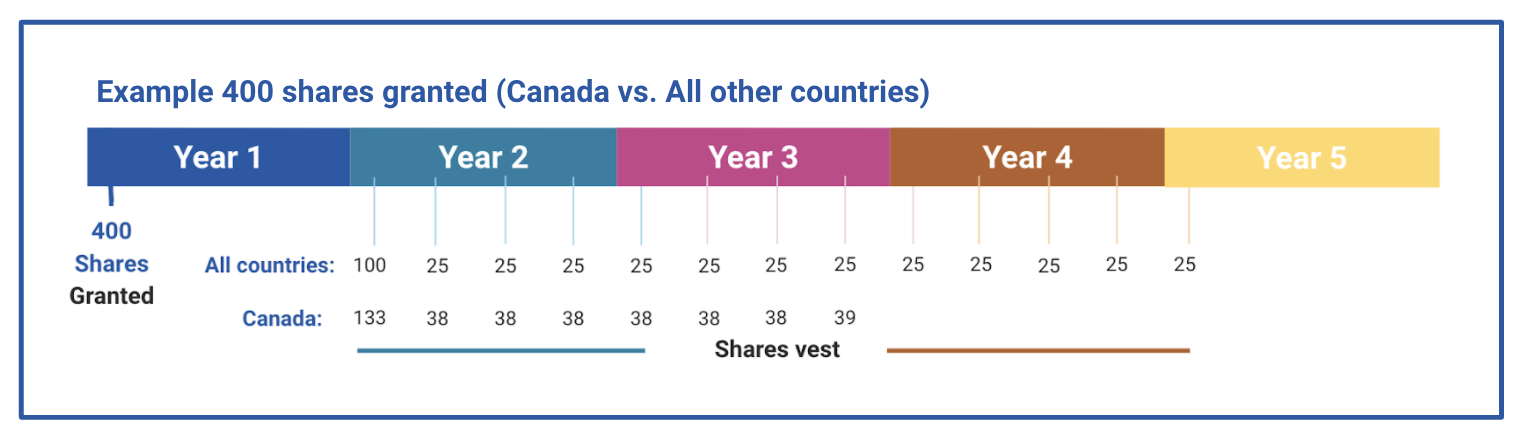

The RSU vesting schedule is the same for all countries Indeed has offices except for Canada. At each vesting date, a portion of the RSUs granted will become shares of Recruit Holdings stock.

Vesting schedule for all countries except Canada

- Total 4 years vesting

- 25% will vest on the first anniversary of your grant

- 6.25% of the award will vest each quarter thereafter over the next three years

Vesting schedule for Canada

- Total 3 years vesting

- 33.3% will vest on the first anniversary of your grant

- 9.524% of the award will vest each quarter thereafter over the next two years

How long can an employee hold their shares?

Once an employee’s shares vest, they can hold their shares until they decide to sell. There is no obligation to sell, even if they leave Indeed. However, they must be employed on their vesting date to receive shares. If they leave the company prior to their vesting date, they will forfeit any unvested shares.

Interested in learning more about benefits at Indeed? Check out our benefits site.

Want to join one of our growing teams? View available jobs here.